Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Registering for a balance transfer credit card is one option to consolidate your credit card bills and better grasp them. These cards make it easy to keep track of your expenses and save money. The catch is this: You’ll need to do some math before deciding on the best debt transfer credit card for you. Calculating the results might be difficult. Thus, we have made this guide on credit balance calculator to aid you.

How to Use this Credit Balance Calculator

Based on the facts you supply, our balance transfer calculator will help you consider your debt-paying alternatives by predicting how much you might even save with a balance transfer.

Consider this tool to assess the possibility of a deal based on your payment history and other variables and determine if a balance transfer is good for you. However, remember that this is simply one option for helping you handle your debt, not a plan for paying it off.

You can use this Credit Balance Calculator through the following steps:

Step 1: Enter the credit amount.

Step 2: Enter the monthly payment

Step 3: Enter the interest rate

Step 4: Enter the number of payments

Step 5: Enter the interest accrual ( monthly, quarterly, semi-annually or annually?

Step 4: Click on “calculate,” The credit balance calculator will provide your estimated credit balance.

Step 5: To recalculate, select “reset,” All of the previous input values will get erased.

Credit Balance Calculator

What is your Total Credit Balance?

A total credit balance is an absolute value owing to a card issuer by a cardholder. Balances shift depending on how and when they get utilized. They rise as cardholders purchase things and fall when they pay the bill.

Any sum left over after the billing cycle gets rolled over to the next month. There is also an interest fee. Credit card balances play a significant role in determining a user’s credit score. Subsequent creditors will use these to assess the risk (and expense) of extending further credit to their clients.

In addition, credit cards are transaction cards that enable consumers and businesses to make transactions without paying cash right away. They allow cardholders to pay for their purchases and services afterward, giving a private and safer shopping experience.

Credit cards, unlike the currency, are widely accepted internationally and may provide rewards such as points or money.

The total cost you owe to your credit card provider is the balance on your bank card. This amount varies from month to month, depending on using your card. It gets made up of several elements, including:

- Transactions

- Transfers of funds

- Exchange rates

- Late payment costs

- Fees for annual membership and cash advances

- Charges for interest

Your credit card amount is also affected by payments. Also, paying your bill amount in full before the due date is usually reasonable. If you make the minimum payment, the leftover debt will roll over to the following billing cycle. You pay interest on the balance, which appears on your next bill.

How do you Calculate Balance Transfer?

You may determine your credit card debt transfer charge by calculating the amount you want to transfer by the rate mentioned on your cardholder contract. That implies that if you shift a $1,000 amount and your card provider charges 3% of the total, your balance transfer fee will be $30.

How do you Calculate a Credit Card Payment?

Another computation is required to determine how much goes into credit card payment. It’s simple math, but it does need a few steps.

- Determine the lending rate on your credit card.

- Divide the yearly rate by 12 to get the monthly rate. Since there are 12 months yearly, this is true.

- Divide your existing debt by the monthly rate.

The result is how much interest you pay on your loan every month.

How can I Pay off Large Amounts of Debt?

If you’re having trouble paying off enormous sums of debt, the following advice will be pretty helpful:

Make a financial plan.

Begin repaying your significant debt by creating a monthly budget to measure your income and spending.

A plan is a simple approach to becoming organized while starting to repay debt. Yours might be as basic as a spreadsheet, and it may also be more complicated if you use budgeting tools to keep track of every spending and debt payment.

Pay off the highest-cost debt first.

The debt avalanche technique entails first repaying loans with the highest returns, starting with the most costly obligation. You must keep paying the least on your other, less expensive bills throughout this repayment approach. Also, put whatever excess money you have towards your most costly loans.

This technique may save you money in the long term by allowing you to pay off problematic debts more rapidly, such as credit card debt.

Start with the smallest debt.

Debt snowballing is a practice that requires debtors to handle the lowest debts first. Starting with a little obligation and returning it in full is more straightforward than taking on a considerable student loan or mortgage, and settling a small debt may give you the drive to keep going on your debt reduction path.

Choosing which debt to pay off first depends on a person’s financial situation and other variables.

Make a larger payment than the required reserves

You’ll probably need to pay more than the minimum sum on your credit card accounts to dent your obligations significantly. Handling debt through credit cards, which usually have high-interest rates, may be pretty expensive.

You might also try paying more money toward your mortgage’s principle. This is true if the additional payments aren’t better spent on other obligations.

Use balance transfers to your advantage

You may transfer your debt from one institution to another via a balance transfer, enabling you to take advantage of special introductory prices. Getting a new credit card and navigating through the application procedure may be impossible for some people. However, this is dependent on the card and other possibilities available.

This technique also works well if you know you’ll be capable of paying off the debt quickly.

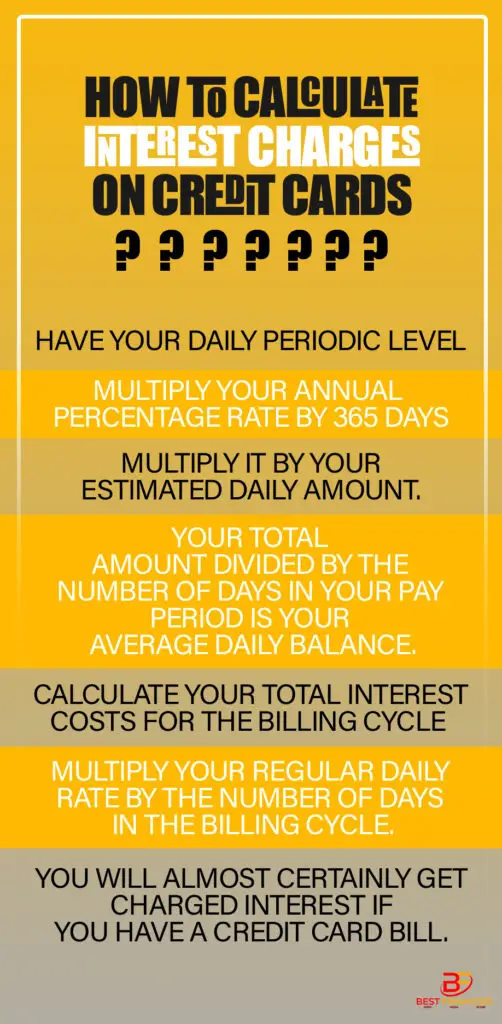

How to Calculate Interest Charges on Credit Cards

To determine your interest costs, you’ll need to know your APR, your estimated average amount, and the number of days in your pay period. Most of this data should be accessible by simply signing into your account.

Following that, do the following steps:

To have your daily periodic level, multiply your annual percentage rate by 365 (the number of days in a year).

Multiply it by your estimated daily amount. Your total amount divided by the number of days in your pay period is your average daily balance.

To calculate your total interest costs for the billing cycle, multiply your regular daily rate by the number of days in the billing cycle.

You will almost certainly get charged interest if you have a credit card bill. Credit card issuers may offer you a different amount of time to pay for new transactions before they incur interest, but most allow you around a month.

How to Pay Less Interest

The only method to avoid credit card interest altogether is to refinance each month. However, there are strategies to cut your interest expenses as you pay off debt drastically. This comprises:

Discharge your credit cards in the sequence of the interest rates.

If you have card debt on many cards, some private finance gurus advise beginning with the least number and working your way up. The notion is that rapid victories would provide you with momentum and drive. However, paying off your cards in order of their bond yields can save you the most revenue. Starting with the highest-rate card, work your way down to the lowest.

Make numerous monthly payments

Credit card issuers calculate interest based on your estimated average amount, not your monthly balance. Paying more often than once every month — after two weeks, for example — can lower your average amount and, with it, your charge costs.

Your average daily amount will be lower the sooner you repay and the more you pay. Think about making a repayment every time you get a paycheck. This is on top of any surpluses you may get, such as a monetary gift or a tax return.

Use a 0% prepaid gift card to reduce your debt.

Registering for a debt transfer card if you owe more than you can repay in the coming months may be suitable. You shift a balance from one account to another when you move a reserve.

Most cards will incur roughly 3% of your balance to shift your debt. A few cards, on either hand, have no such cost or eliminate it for a limited period. Excellent or exceptional credit is usually required to get authorized, and you also can’t send debt across cards from the same company.

Make a strategy to pay down your credit card bills before the promotional rate of 0% ends if you do a balance transfer. This is correct, and you will not have to pay any interest.

How do you Calculate your Credit Card Due Date?

Payments are due 21-25 days after the date specified or after the repayment period has ended. The equity credit term or time limit granted by your card issuer is the time between the date of invoice and the repayment date.

Frequently Asked Questions

Is balance the same as credit?

No. The sum of all posted operations is your existing balance as of the previous business day. Your accessible credit gets computed by deducting your financial position (or the amount previously utilized) from your line of credit and including any unpaid charges.

Which account has a credit balance?

Credit balances are standard in liabilities, income, and owner’s capital accounting.

Which method for calculating credit card balances is best for you?

The best way to determine credit card balances is to use the current average value. It funds your account the day the issuer receives your transaction. The issuer tallies the initial balance for each day of the billing month to determine the sum payable. He then deducts whatever credits you received that day from your account.

What if my credit card has a positive balance?

In months when you use your card, you’ll tend to have a high balance – suggesting you loaned money. You will not get charges if you clear off such accounts in full by the deadline each quarter, and your account will remain in good status as you pay at least the necessary amount.

Should I pay the statement balance or balance?

In principle, you should pay down your bill balance first. You may avoid paying interest on the credit card payment if you regularly pay up your bill amount in whole by the due date of every payment cycle.

What happens if you have a balance on your credit card?

If you maintain a debt, you’ll almost certainly get billed a yearly proportion (APR) of your card on the amount of the amount you didn’t pay. You won’t be fined or charged for a specific time if you’ve got a zero-interest promotional deal.

What is a credit balance refund?

When you seek a return of your deleterious credit card balance, you will get a credit card balance reimbursement.

What does credit balance mean renting?

If an account has “CR” after it, it signifies you’re in credit and don’t have to pay anything.

What do you mean by credit balance in the ledger?

The credit line in accounting refers to the difference between the credit and debit sides of a ledger. According to fundamental accounting concepts, obligations, Incomes, Assets, Deposits, Allowance, and Contra Expenditure ledger accounts generally have a balance due.

How long will it take to pay the credit card off?

A reasonable general rule is to repay any credit card debt within 36 months. However, you may wish to investigate the costs of paying off the debt in lengthier periods.

How much credit balance is too much?

Since there is no defined benchmark for what constitutes a high credit use percentage, many money managers recommend aiming for a credit limit ratio of 30% or less.

What does a credit balance in the bank account mean?

A credit line is the card’s final total, which might be favorable or unfavorable depending on the circumstances.

How long would it take to pay off a credit card balance of $15 000 paying just minimum payments?

Clearing off a $15 000 credit card bill with just repayments would require 227 months.

How long will it take to pay off $30000 in debt?

Paying $30,000 in credit card debt would require 447 months (upwards of 37 years).

How many days before my credit card due date should I pay?

The time between the closing date of your assertion and the payment due date is usually 20–25 days. The time limit is when you have to assemble the funds to reimburse your credit card balance.

Can I use my credit card between the due date and closing date?

In between the bill closing date and the due date for most credit cards, you get a time limit of 21 to 25 days.

Can you pay a credit card the day it’s due?

Each month, credit card transactions are payable on the same day and period, usually 5 p.m. or later. As per the CARD Act, a credit card transaction does not get deemed late if collected by 5 p.m. on the due date. If you pay your account online, certain card issuers may extend the due date, providing far more time to pay.