Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

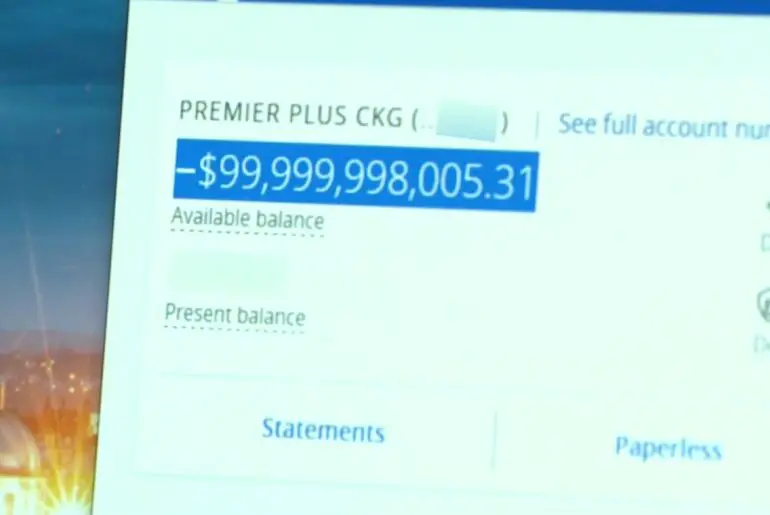

If you find yourself in a complex financial situation, you may spend more money than you have and bring your Chase account below zero balance. This might be a pure coincidence due to bad timing. Another great example is when your account gets a draft because of a credit card bill before receiving your salary. In this guide, I will teach you how to close a chase account with a negative balance.

This can also be a symptom of a more severe financial problem that you need to address. Today, many people usually try to close Chase accounts with negative balances. This is very difficult, and you risk a slew of adverse effects if you manage to get around it. As a result, we’ve written this article to assist you. If you find yourself with a very low chase account balance, here is what you need to know.

Facts You Need to Know About Chase Account with Negative Balance

Overdraft vs. Inadequate Funds

The overdraft agreement you have with your bank is the first and most crucial item to grasp in this circumstance. You have an overdraft when you make a transaction on your account that reduces the amount below zero. This can be because of a variety of factors.

This may be a check you wrote, a debit card charge you made, an automated payment that went through, or an ATM withdrawal attempt. Notably, various transactions may be treated differently by banks. Check transactions are subject to different restrictions than ATM and one-time debit card transactions.

Probable outcomes

When you incur a charge on your account, three possible consequences might result in a negative balance.

First, your bank may cover the expense and charge you an overdraft fee. When you have “overdraft coverage,” this occurs. For debit card transactions, you must opt for overdraft protection.

Other transactions, however, may be automatically covered by your bank. While your account is negative, some banks will continue to charge you for any new transactions you make. These costs may be relatively high, and if you have to pay them many times, they can soon mount up.

Second, you may be able to offset the charge with cash from another account you control. If you’ve chosen “overdraft protection,” this will happen. If that’s the case, you’ve connected a second account to your checking account as a backup. When the main account’s balance falls below zero, you can utilize monies from the other account to make up the difference.

Your connected account should ideally be a savings or another checking account. You should avoid using a credit card as a backup account since it will undoubtedly be in a cash advance category.

Third, if you don’t have overdraft protection or coverage and your bank refuses to pay the charge, the transaction will encounter rejection. Nonsufficient Funds (NSF) or “insufficient funds” is why it denies the charge. In most circumstances, you’ll owe an “NSF fee,” which is typically the same as an overdraft cost charged by the bank.

Close Chase account with negative balance: The Way Out

If you have overdrawn your Chase account or have liquidity issues, here are steps to consider taking before closing it:

Transfer money

If you have money to finance the expense or to add padding to your account, you could perhaps make a transfer. A swift transfer can help avoid numerous overdrafts in a short amount of time. It can also enable you to reengage a charge from a merchant that failed due to inadequate funds.

Ask for waived fees

If you incur bills for an overdraft or NSF fee, consult your bank and ask them to relinquish it. It never hurts to inquire, and if this is your first time, the bank may be prepared to forgo the cost as a one-time courtesy.

Take care of your fees

Alternatively, if you cannot avoid the cost, make sure to pay it. Failure to pay an overdraft charge before terminating an account might result in various problems. The bank has the authority to take legal proceedings against you and to report your nonpayment. It may be harder to establish bank accounts in the future due to this.

Avoid legal issues by paying third parties

It’s an issue if a merchant or other third party tries to make a charge on your account and wasn’t paid, whether from a check you made or an ACH. This would happen in the above-mentioned “NSF” situation. In this scenario, you must not only settle with the bank to pay the NSF charge, but you must also settle with the third party.

You owe them money, and failing to pay them might result in negative repercussions. It’s typically advisable to resolve things as soon as possible and peacefully. Call the seller, explain the error, and pay the required amount.

How to Close your Chase account

After you’ve paid off your negative amount, you may terminate your Chase bank account by following these steps:

Make a phone call to start the process.

Calling Chase and having a customer care agent cancel your account may be the fastest option to close your account. For the customer care person, have the following information ready:

- Your whole name

- Checking account

- Your mailing address

- Phone number

- Current balance

- Debit card number

Call 800-242-7338. Follow the steps, which may involve entering your account’s last four numbers as well as your zip code. You may be required to give additional information while speaking with a customer support person. Request that your account be closed and follow the person’s instructions.

Pay a visit to a Chase Bank.

If you live near a Chase bank location, contact them to see if you need to make an appointment to cancel your account. Find out what days and hours account representatives are most likely to be available. Request to talk with a banking specialist at the bank.

Your picture I.D., checking bank details, one copy of your checking bank statements, chequebook, and debit card should all be on hand. To cancel your account, you won’t need all of them.

However, the more papers you have, the less likely it is that you will not have all of the details the bank requires. You may not need your chequebook, statement, or debit card, but you will want your account details.

Your bank representative may offer to trash your checks or debit card once you terminate the account. Before the closing process begins, be ready for a sales presentation. The bank representative may follow a script when consumers ask to close an account. She may offer to waive your costs or provide you with other incentives to remain with Chase.

Go to Chase’s website.

If you haven’t already done so, go to the Chase webpage and log in to your account. Create an account if you haven’t already. You’ll need your name, payment details, and phone number linked with the account, your Social Security number, and your postal address. Enter the words “deactivate” or “close” or a sentence like “close my account” into the search tool.

You can also arrange a phone call with Chase, which will take two days to arrive. To get started, go to the Secure Message Center website. The link will take you straight to the schedule page. You may also use the link to get further contact information.

Cancellation through mail

Visit the Chase webpage to get the most up-to-date postal address for cancelling your account in writing. National Bank By Mail P.O. Box 6185 Westerville, OH 43086 was their customer service address as of November 2021.

Use the following address to send an overnight signed letter: National Bank 340 S. Cleveland Ave Building 370 Westerville, OH 43081 United States Mail Code OH1-0333.

You can contact Chase through phone numbers and email addresses available on various websites. Your monthly account statements may even have two contact information: a return address and a postal address for payments. If possible, contact Chase to confirm that the given locations are still valid.

You’ll be asked to input account-related information. This may include your name, address, account number, Social Security number, phone number).

Again, it’s a good idea to call Chase beforehand to ensure that you follow the proper procedures for cancelling your account in writing. The customer care professional may email you a form to complete the process.

Frequently Asked Questions

Can I close the Chase account with a negative balance?

No. You can’t close a Chase account with a negative balance. However, you may terminate the account using the outlined methods after you’ve paid off your overdraft.

Is there a charge to close a Chase account?

There is no charge to terminate your account, but ensure you don’t overdraw it and the amount is zero.

Is it possible for a bank to terminate your account against your consent?

Yes. Your bank has the authority to cancel your account without your consent. However, if your account has an overdue negative amount from overdrafts, this is more likely to happen.

Does closing your Chase bank account upset your credit?

No. Closed bank accounts are not often collected by credit reporting bureaus.

Conclusion

In conclusion, Chase bank accounts come with various merits. And if you desire to close a Chase account with a negative balance, the tips highlighted above will aid you immensely.