Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Do you like to travel? If so, opting for the best credit card for travel rewards or miles could be an excellent choice for your profile. Miles are loyalty points that, when accumulated, can become rewards for airline customers.

Therefore, with every purchase made on your credit card, you earn miles that you can exchange for airline tickets. In addition to airline tickets, a credit card with miles can also offer other benefits, such as travel insurance, access to VIP lounges at airports and checked baggage allowance.

When choosing a credit card, you must know your profile as a consumer because, in this way, you will be able to identify which features and benefits a card should have to meet your needs.

How to Compare the Best Credit Card for Travel Rewards

:max_bytes(150000):strip_icc()/Primary_Image-c1aa50472041473193397dcb3f4ea23c.jpg)

No card is alike, so what’s suitable for a friend of yours may not be so good for you. Therefore, it is essential that before taking out a credit card, you consider both the characteristics of that card and your characteristics as a consumer.

With that in mind, we have highlighted some essential points that you should pay attention to before applying for a credit card for travel rewards.

Pay attention to the credit card annuity fee

Generally, cards that offer more benefits for travel rewards have higher annual fees. With that in mind, make an accounting of all your expenses. This will help you to find out if this card option is advantageous for your profile.

You must consider that some cards waive the annual fee as long as you spend a certain amount per month. For example: if your card requires a monthly minimum of $1,000.00 for exemption and your bill usually comes with an amount higher than that, you should not worry about the annual fee.

Beware of the expiration date

You must pay attention to the expiration date of your points. Each firm sets a maximum period for trading, and the longer it is, the better it will be for you, as you will have more time to accumulate points.

This item needs to be considered because if you don’t have this date in mind, your points may expire, and you’ll lose everything you’ve accumulated over the months.

Attention when exchanging points

The airlines have a limited amount of tickets intended for points and miles. Thus, to avoid unexpected hassles, you must book your ticket well in advance.

Credit card with miles or with cashback?

Choosing between a credit card with miles and a card with cashback is a recurrent problem among people. But with good analysis, it doesn’t become all that difficult to figure out which one is right for you. By evaluating and understanding your behaviour as a consumer, you can decide which card style will provide the most benefits.

Best Credit Card for Travel Rewards

The best allies for travel, believe it or not, are credit cards because you can solve different unexpected situations with them. Some credit cards for travelling are designed and developed to meet these needs, with unique benefits and tangible rewards. For example, points for travel, miles or days of accommodation.

Fortunately, many banks have the best credit cards for travel that adapt to each traveller’s style, personality, needs, and possibilities. They are very different between them, ranging from the essential benefits and requirements to the most complete.

Furthermore, before deciding on a credit card for travel rewards, the recommendation is to consider the frequency with which you travel. The budget you allocate for each trip is also essential because you will surely not need the same as if you travel low-cost style or for pleasure if you travel for business.

The best credit card to travel with will also be the one that offers you rewards and benefits related to transportation or destinations. In this way, you can consume as you always do and have an additional advantage for using your card frequently. Some of these cards include:

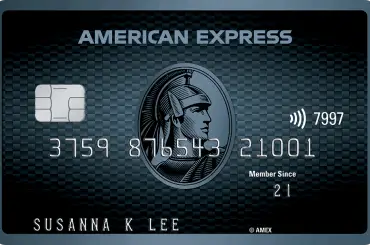

American Express Starwood Guest travel credit card

This is one of the best credit cards for travel rewards, usually chosen for its excellent compatibility with hotels. If you frequently stay at Starwood hotels, you can accumulate great SPG points with this card from American Express. You can then transfer them to your favorite frequent flyer program, usually at a 1: 1 rate.

Overall, the card’s high win rate and flexible redemption make it a solid option for travelers and frequent hotel guests alike. This Travel Credit Card from American Express offers up to 5 Star points for every $1 spent at participating SPG locations and 1 Star point on all other purchases.

Redeeming points for hotel stays provides the highest number of dollars per point, but you can roll over Star points to more than two dozen frequent flyer programs.

The card comes with a sign-up bonus: You earn an additional 25,000 Star points after using your new card to make $ 3,000 in combined purchases within the first three months.

Chase Sapphire Preferred credit card

The Chase Sapphire Preferred credit card is selected for its airline travel rewards and its great bonus. If you’re primarily traveling on an airline and desire flexibility in earning and redeeming rewards, this is one of the best cards you can find.

You earn 2 points on food and travel for $ 1 spent and 1 point for $ 1 spent on everything else. These points are worth over 30% more when you use them to make reservations for rides through Chase points. You can also transfer them to other preferred loyalty programs. Furthermore, the card contains a welcome bonus.

After paying $4,000 on transactions in the first 3 months after creating a profile, each user receives 50,000 bonuses. When you earn with Chase Ultimate Rewards, you’ll get $625 in travel.

Capital One Venture Rewards credit card

This card stands as one of the best cards for travel rewards. When it comes to thousands of miles to earn and redeem, the Capital One Venture Rewards credit card is hard to beat. If you want to redeem miles for hotel stays, flights, taxi rides, or cruises, it has you covered.

This travel rewards credit card stands as one of the most flexible options available. Here, you can easily earn 2 miles for every $ 1 you spend on everything. You also redeem rewards for a credit against most travel expenses. With this travel rewards credit card, you are not restricted to an airline or hotel, as with co-branded cards.

If you just booked your trip, then you pay for it with your rewards. The annual fee is relatively low concerning other travel cards, and there are no overseas transaction fees, making it ideal for traveling abroad.

This card also comes with a sign-up bonus: Enjoy a one-time bonus of over 40,000 miles once you spend at least $ 3,000 on purchases within the first three months of approval. This equates to over $ 400 on trips.

Bank of America Travel Rewards card

This Travel Rewards card is chosen because it does not have an annual fee. The card is very competitive if you are a Bank of America customer, especially if you have a lot of money in your accounts.

You will enjoy flexible refund policies, and you will not pay an annual fee. However, without a Bank of America account, you will lose a large part of the value of this card. With this card, you earn 1.5 points for every $ 1 spent, and each point is worth 1 cent. It’s a relatively high rewards rate considering the card has an annual fee of $ 0.

Also, if you are a Bank of America customer, you can earn 10% to 75% bonus miles when redeeming, depending on how much you have in your accounts. You can exchange points for a credit against travel purchases, giving you the freedom to book with any company or hotel chain during any season.

You can also use rewards points to get credit against travel purchases up to 12 months after the purchases are posted to your account. It offers a much wider window than other cards.

The card further comes with a sign-up bonus. This entails 20,000 bonus points online if you make at least $ 1,000 worth of purchases in the first 90 days. You can resolve this into a $ 200 credit for travel purchases.

Scotia Travel Classic credit card

The Scotia Travel Classic credit card is undoubtedly one of the best travel rewards credit cards, as it offers attractive discounts on hotels, plane tickets, and more. This card rewards your loyalty, offering you some Scotia Points, which you can redeem to pay in various stores during your trip.

The card gives you an attractive and well-deserved welcome bonus of 8,000 points if you are a new user. You only have to spend a minimum of $ 33,000 in the first three months.

Your insurance options with this card are excellent. It gives you up to $100 if damage or accident occurs on your trip. In addition, it has luggage protection, giving you a maximum of $ 500 in case of loss.

Conclusion

In conclusion, credit cards for travel rewards come with several benefits. Since they have agreements with airlines and hotels, they offer miles or kilometers redeemable for plane tickets, documentation and priority boarding, access to VIP lounges, as well as additional luggage at no cost. If you desire to enjoy all these and many more, the highlight of the best credit card for travel rewards above would be indispensable for you.